Anytime a staff member has been terminated they can be added back to Single Touch Payroll Pay or Finalisation Event.

Terminations before 31 March strategy

- Have a methodology or process for ensuring grossed up RFB is calculated where a termination pay is being prepared. Amounts under $2000 do not need to be reported.

- Once the payrun and termination pay has been finalised, and before lodging with the ATO, go into the pay event screen by clicking on “Lodge Pay Run with the ATO”

- Find this tiny blue symbol which allows you to access the column set up:

- On the list of columns tick RFB so that it appears as a column.

- Anytime an employee doesn't show in a finalisation event because they have been terminated, you can add them to the lodgement without having to reinstate them.

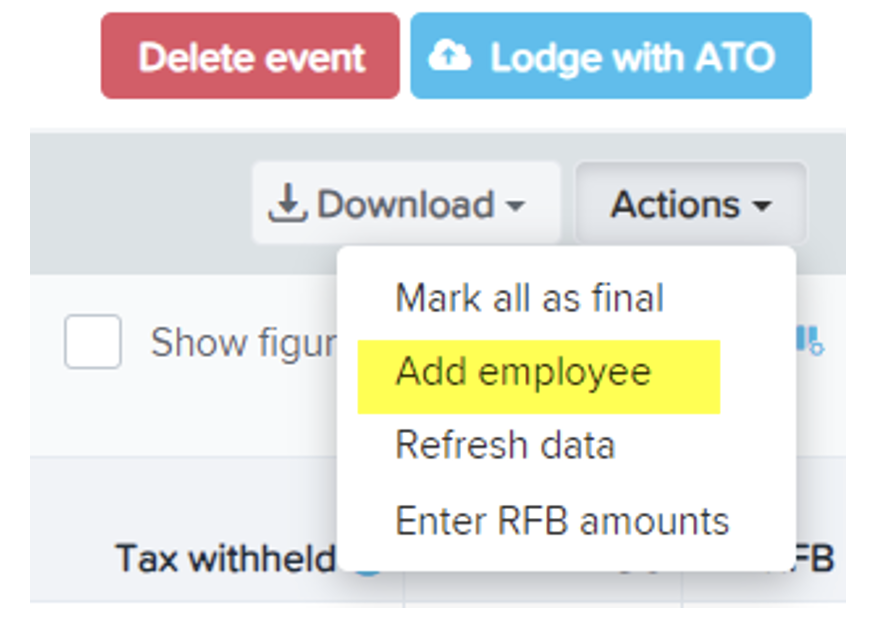

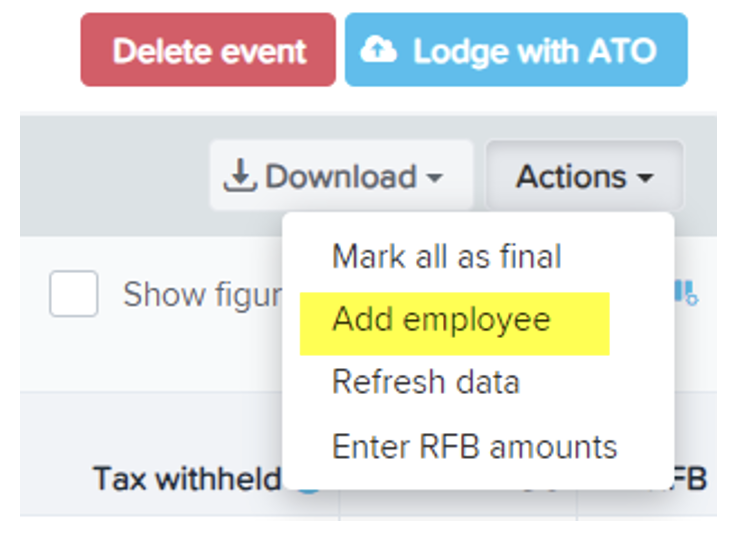

- USe the 'actions' button - not far from the mysterious column symbol

- Use the 'actions' button again:

- Click on the 'Enter RFB amounts" and match the payment to the appropriate finalising staff member

- Lodge as normal.

Strategy for terminations 31 March and 30 June

- RFB in this period would be reported in the next financial year.

- Apply the RFB after 1 July during a pay event or during finalisation the following year.

- Make sure your RFB column is showing in the Pay or Finalisation Event page (see above)

- Anytime an employee doesn’t show in a finalisation event because they have been terminated you can add them to the lodgment without having to reinstate them.

- Go to Actions:

- The only employees available on this list are employees who are terminated at the time of the event.

- Then go back and click on enter RFB amounts and finish by doing the data entry.